How can one maximize tax savings? Maximize Tax Savings: Comprehensive Guide To Income Tax Reliefs is here to answer this question.

Editor's Notes: Maximize Tax Savings: Comprehensive Guide To Income Tax Reliefs have published today, Date. Deciding which tax reliefs to claim can be overwhelming. That’s why this topic is important to read.

After some analysis and digging around, we have put together this Maximize Tax Savings: Comprehensive Guide To Income Tax Reliefs guide to help you decide which tax reliefs you are able to claim.

Key differences or Key takeways:

| Reliefs | Description | Amount |

|---|---|---|

| Earned income credit (EIC) | A tax credit for low- and moderate-income working individuals and families. | Up to $6,935 for 2023 |

| Child tax credit (CTC) | A tax credit for parents of children under age 17. | Up to $2,000 per child for 2023 |

| Adoption tax credit | A tax credit for adopting a child. | Up to $14,890 per child for 2023 |

| Saver's credit | A tax credit for low- and moderate-income taxpayers who save for retirement. | Up to $1,000 for 2023 |

Income Tax Filing 2019 - Everything You Need to Know About Tax - Source blog.moneysmart.sg

Main article topics:

FAQ

Maximize Tax Savings: Comprehensive Guide To Income Tax Reliefs

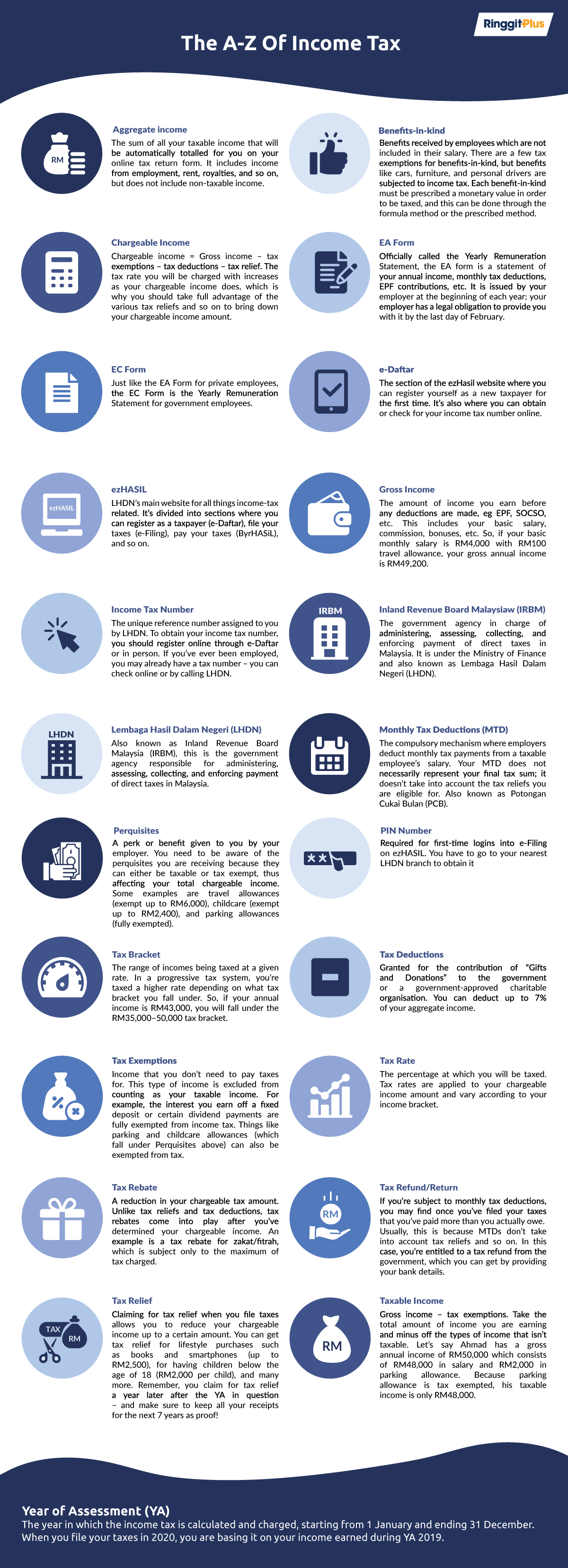

Malaysia Income Tax: An A-Z Glossary - Source ringgitplus.com

Question 1: What are deductions under the Income Tax Act?

Deductions are expenses that are allowed to be subtracted from an individual's gross income when calculating their taxable income. The Income Tax Act provides a list of eligible deductions, such as contributions to certain savings plans and medical expenses.

Question 2: How can I utilize exemptions to reduce my tax liability?

Exemptions are specific amounts that are subtracted from taxable income before applying tax rates. The Income Tax Act provides exemptions based on various factors, such as age, disability, and dependent status. Utilizing these exemptions can effectively reduce tax liability.

Question 3: What are the benefits of investing in tax-saving instruments?

Investing in tax-saving instruments, such as Public Provident Fund (PPF) or National Pension System (NPS), offers dual benefits. Not only do these investments provide potential long-term returns, but they also allow individuals to claim deductions or exemptions under the Income Tax Act, reducing their taxable income.

Question 4: Can I claim medical expenses as a deduction?

Yes, certain medical expenses incurred for the treatment of specified diseases or disabilities can be claimed as a deduction under the Income Tax Act. However, there are specific limits and conditions for claiming these deductions.

Question 5: What is the impact of home loan interest on my taxes?

Individuals who have taken out a home loan can claim a deduction for the interest paid on the loan. This deduction is available up to a certain limit and can significantly reduce an individual's tax liability.

Question 6: How can I ensure I am utilizing all available tax benefits?

To maximize tax savings, it is crucial to stay informed about the latest tax laws and amendments. Consulting a tax professional can also be beneficial, as they can provide personalized advice and help individuals navigate the complexities of the tax system.

By understanding these tax reliefs and exemptions, individuals can effectively reduce their tax liability and optimize their financial well-being.

Next: Understanding Different Types of Income Tax Reliefs

Tips

Maximize your tax savings by leveraging income tax reliefs. Consult Maximize Tax Savings: Comprehensive Guide To Income Tax Reliefs for in-depth guidance.

Tip 1: Leverage Deductions

Reduce your taxable income by claiming allowable deductions, such as medical expenses, charitable contributions, and student loan interest. These deductions directly lower the amount you owe in taxes.

Tip 2: Utilize Tax Credits

Tax credits are direct reductions to your tax liability, making them even more valuable than deductions. Explore credits for expenses like child care, education, and energy efficiency, which can significantly reduce your tax bill.

Tip 3: Optimize Retirement Contributions

Maximize contributions to tax-advantaged retirement accounts, such as 401(k)s and IRAs. These contributions reduce your current taxable income while potentially growing tax-free until retirement.

Tip 4: Explore HSA Contributions

Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. Consider HSAs if you have a high deductible health plan.

Tip 5: Harvest Capital Gains and Losses

Strategically selling assets to realize capital gains and losses can help offset taxable income or lower future capital gains taxes. Consult with a financial advisor to determine the optimal timing for these transactions.

By implementing these tax-saving tips, you can legally minimize your tax liability and maximize your financial well-being.

Maximize Tax Savings: Comprehensive Guide To Income Tax Reliefs

Maximizing tax savings requires an understanding of income tax reliefs. These reliefs offer various ways to reduce tax liability, encompassing deductions, exemptions, and credits.

- Understand Deductions: Expenses that can be subtracted from taxable income, such as mortgage interest or charitable contributions.

- Explore Exemptions: Specific amounts of income that are not subject to taxation, like the basic personal exemption.

- Utilize Credits: Direct reductions in tax liability, such as the child tax credit or earned income tax credit.

- Plan Retirement Contributions: Contributions to retirement accounts, like 401(k)s or IRAs, may be tax-deductible or tax-deferred.

- Consider Itemized Deductions: A list of specific expenses that can be deducted from taxable income, such as medical expenses or state and local taxes.

- Maximize Standard Deduction: A set amount that can be deducted from taxable income without itemizing.

By leveraging these key aspects, individuals can minimize their tax liability. Deductions reduce taxable income, while exemptions and credits directly reduce tax owed. Retirement contributions and itemized deductions offer further tax-saving opportunities. Understanding these concepts empowers taxpayers to navigate the complexities of the tax code and maximize their savings.

IRAS | Tax savings for married couples and families - Source www.iras.gov.sg

Maximize Tax Savings: Comprehensive Guide To Income Tax Reliefs

The comprehensive guide to income tax reliefs serves as an invaluable resource for maximizing tax savings. Understanding the nuances of tax laws and available reliefs empowers individuals to minimize their tax liability while ensuring compliance with regulations.

Income tax calculator free image download - Source www.quoteinspector.com

By leveraging tax-saving strategies, individuals can optimize their financial well-being. The guide provides practical insights into eligible deductions, exemptions, and credits, enabling informed decision-making during tax preparation. Neglecting these reliefs can result in higher tax payments, potentially hindering financial progress.

The guide also emphasizes the importance of record-keeping and documentation to support tax claims. Accurate and timely record-keeping ensures that individuals can substantiate their deductions and minimize the risk of tax audits. By staying informed about tax reliefs and adopting prudent financial practices, individuals can effectively maximize their tax savings and enhance their financial stability.

Conclusion

In conclusion, the comprehensive guide to income tax reliefs provides essential knowledge and practical strategies for maximizing tax savings. By understanding the available reliefs and utilizing them effectively, individuals can minimize their tax liability and optimize their financial well-being. The guide serves as a valuable tool for financial planning, empowering individuals to make informed decisions and achieve their financial goals.

However, it is crucial to stay updated on tax laws and regulations as they may change over time. Regular consultation with tax professionals or referencing official tax resources is recommended to ensure compliance and maximize tax savings. By adopting a proactive approach to tax planning, individuals can achieve financial security and peace of mind.