Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment

Editor's Notes: Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment have published today date" to give you a leading edge insight on Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment. And this is must read because it contains safety and investment to Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment.

In this economy, it is important to be able to make wise investments to protect your financial future. Ghana Treasury Bills (T-bills) offer investors a secure and lucrative way to do this. We have done some analysis, digging information, made Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment we put together this Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment guide to help target audience make the right decision.

Here are some of the key differences between Ghana Treasury Bills and other investment options:

| Investment Option | Risk | Return |

|---|---|---|

| Ghana Treasury Bills | Low | Moderate |

| Stocks | High | High |

| Bonds | Moderate | Moderate |

| Real Estate | Low | Moderate |

As you can see, Ghana Treasury Bills offer a low level of risk and a moderate return. This makes them an ideal investment for those who are looking for a safe and stable way to grow their money.

FAQ

Ghana Treasury Bills are renowned for their reliability and security in the realm of investments. This comprehensive guide delves deeper, addressing various concerns and misconceptions surrounding these bills.

Treasury Bills vs Treasury Bonds: Know the Difference | Kiplinger - Source www.kiplinger.com

Question 1: Are Ghana Treasury Bills susceptible to market fluctuations that may result in losses?

Ghana Treasury Bills generally carry minimal risk as they represent a direct obligation from the Government of Ghana and are backed by the full faith and credit of the country. However, it's crucial to note that interest rates are subject to market forces. While interest rate fluctuations are possible, they tend to be more stable compared to other investment options.

Question 2: What safeguards are in place to protect investors in Ghana Treasury Bills?

Ghana's Treasury Bill market is rigorously regulated by the Bank of Ghana, the country's central bank. This regulatory framework ensures transparent issuance, trading, settlement, and redemption processes, providing significant protection to investors.

Question 3: Is the process of purchasing and redeeming Ghana Treasury Bills complex?

The process is designed to be accessible and convenient. Investors can buy or redeem Treasury Bills through licensed banks, brokerage firms, and other authorized financial institutions that participate in the Ghanaian government securities market.

Question 4: What advantages do Ghana Treasury Bills offer over other investment options?

Ghana Treasury Bills are characterized by their high level of liquidity, enabling investors to easily convert them into cash when needed. This liquidity, coupled with their low risk and competitive interest rates, make them an attractive investment choice, especially for short-term capital needs.

Question 5: Are there different types of Ghana Treasury Bills available?

Yes, there are various types of Ghana Treasury Bills, categorized based on their maturity dates, ranging from 91 days (3-month bills) to 364 days (1-year bills). Investors can choose the maturity that best aligns with their financial goals and risk tolerance.

Question 6: What are the potential challenges associated with investing in Ghana Treasury Bills?

While Ghana Treasury Bills are generally considered low-risk investments, it's essential to be aware of potential factors that could impact returns. These include changes in monetary policy, economic conditions, and political developments. Comprehensive market analysis and understanding of the investment landscape are key to navigating these challenges.

Ghana Treasury Bills remain a cornerstone of the Ghanaian financial system and continue to attract significant investor interest. By addressing these frequently asked questions, this guide aims to provide a thorough foundation for informed investment decisions in Ghana Treasury Bills.

Exploring the subsequent sections will further enhance your knowledge, empowering you to make well-informed investment choices tailored to your specific needs and objectives.

Tips

Treasury bills are a safe and secure investment option. They are backed by the full faith and credit of the government, and they offer a competitive rate of return. However, there are a few things you should keep in mind when investing in treasury bills. Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment

Tip 1: Make sure you understand the risks involved. Treasury bills are considered a low-risk investment, but there is always some risk involved. For example, the value of your investment could decline if interest rates rise.

Tip 2: Do your research. Before you invest in any treasury bill, make sure you do your research and understand the terms and conditions.

Tip 3: Diversify your investments. Don't put all of your eggs in one basket. If you are investing in treasury bills, make sure you also invest in other types of investments, such as stocks and bonds.

Tip 4: Consider your investment goals. Before you invest in any treasury bill, make sure you consider your investment goals. Are you saving for retirement, a down payment on a house, or something else?

Tip 5: Talk to a financial advisor. If you are not sure how to invest in treasury bills, talk to a financial advisor. They can help you create an investment plan that meets your needs and goals.

Summary of key takeaways or benefits: Treasury bills are a safe and secure investment option, but there are a few things you should keep in mind when investing in them. Make sure you understand the risks involved, do your research, and diversify your investments. Consider your investment goals and talk to a financial advisor if you are not sure how to invest in treasury bills.

Transition to the article's conclusion: Treasury bills can be a great way to save money for the future, but it is important to understand the risks involved and make sure that they are right for you.

Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment

Ghana Treasury Bills are highly secure short-term government debt instruments that offer attractive returns to investors. This guide provides an overview of Ghana Treasury Bills, including their safety, investment process, and other essential aspects.

What are Treasury Bills or T-Bills in India? - Source kuvera.in

- Ghana Treasury Bills: Overview: Treasury Bills in Ghana are short-term debt instruments issued by the Government of Ghana. They are designed to raise funds for the government's short-term financial needs.

- Safety and Security: Treasury Bills are considered highly secure investments. They are backed by the full faith and credit of the Government of Ghana, and are therefore considered a low-risk investment.

- Investment Process: Investing in Treasury Bills in Ghana is straightforward. Individuals and institutions can purchase Treasury Bills through authorized dealers or brokers. The minimum investment amount is typically GH¢100.

- Interest Payments and Returns: Treasury Bills pay interest on a discounted basis. The interest rate is determined through an auction process. Returns on Treasury Bills are typically higher than those offered by commercial banks.

- Maturity and Redemption: Treasury Bills have maturities ranging from 91 to 364 days. At maturity, the face value of the Treasury Bill is repaid to the investor.

- Secondary Market Trading: Treasury Bills can be traded in the secondary market before maturity. This allows investors to exit their investments before the maturity date.

Ghana Treasury Bills are a valuable investment option for individuals and institutions seeking a secure and profitable investment. They offer attractive returns, are backed by the government, and are easily accessible. By understanding the key aspects of Treasury Bills, investors can make informed decisions and benefit from this important financial instrument.

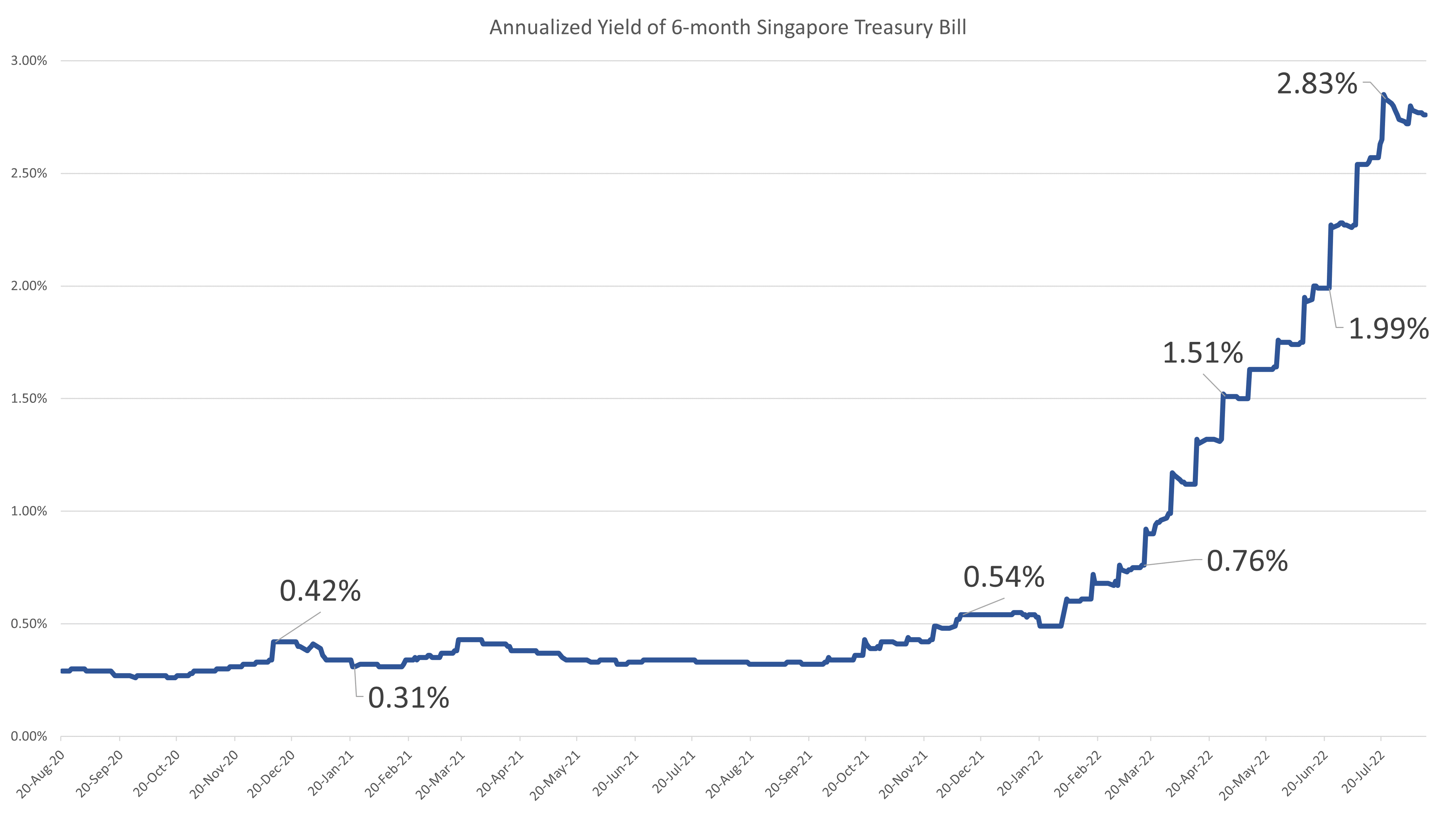

How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS - Source investmentmoats.com

Ghana Treasury Bills: A Comprehensive Guide To Safety And Investment

This guide provides a comprehensive overview of Ghana Treasury Bills (T-Bills), encompassing their safety features, investment considerations, and practical implications. Comprehending this information empowers investors to make informed decisions regarding T-Bills.

What Is a Treasury Bill? Full Guide to T-Bills - Source changelly.com

T-Bills play a crucial role in Ghana's financial landscape, serving as low-risk, short-term investment instruments issued by the government to finance short-term budgetary needs. Their safety stems from the government's guarantee of repayment, making them attractive to risk-averse investors. Additionally, T-Bills offer competitive returns, contributing to their popularity among both individual and institutional investors.

Understanding the nuances of T-Bills is essential for investors seeking to optimize their returns and mitigate risks. This guide thoroughly examines the factors influencing T-Bill yields, including inflation, interest rate fluctuations, and market demand and supply dynamics. It also delves into the various types of T-Bills available, their respective maturities, and the processes involved in purchasing and redeeming them.

To illustrate the practical significance of this understanding, the guide presents real-life examples of how investors have utilized T-Bills to achieve their financial goals. It highlights the role of T-Bills in portfolio diversification, liquidity management, and risk mitigation.

Conclusion

This comprehensive guide to Ghana Treasury Bills has explored the intricacies of these investment instruments, emphasizing their safety features and investment considerations. Understanding the mechanics of T-Bills empowers investors to make informed decisions, navigate market dynamics, and effectively utilize T-Bills to achieve their financial objectives.

Ghana Treasury Bills continue to play a vital role in the country's financial ecosystem, providing a safe and reliable investment avenue for both individuals and institutions. As the government's commitment to economic stability remains steadfast, T-Bills are expected to maintain their allure as a cornerstone of investment portfolios in Ghana.