Searching for comprehensive guide about "BioNTech Aktie: Ein Umfassender Leitfaden Für Investoren" ?

Editor's Notes: Comprehend the "BioNTech Aktie: Ein Umfassender Leitfaden Für Investoren" published today date. This topic is very important to read because It provides a wealth of information on the company's history, financial performance, and future prospects.

We have done some analysis, digging information, and made BioNTech Aktie: Ein Umfassender Leitfaden Für Investoren. We put together this guide to help you make the right decision.

FAQ

This comprehensive guide provides potential investors with a thorough understanding of BioNTech stock, covering its performance, prospects, and potential risks.

Question 1: What are the key drivers of BioNTech's stock performance?

Answer: The company's success in developing and commercializing its mRNA-based COVID-19 vaccine, as well as its strong pipeline of potential new therapies, have been significant drivers of its stock performance.

Question 2: What are the potential risks associated with investing in BioNTech?

Answer: As with any investment, there are risks involved with investing in BioNTech. These include the risk of clinical trial failures, regulatory setbacks, and competition from other pharmaceutical companies.

Question 3: What is the company's long-term growth strategy?

Answer: BioNTech aims to become a global leader in the development and commercialization of mRNA-based therapies. The company is focusing on expanding its pipeline of potential therapies, including programs targeting cancer, infectious diseases, and rare diseases.

Question 4: What are the key financial metrics to consider when evaluating BioNTech?

Answer: Investors should consider the company's revenue growth, profit margins, research and development expenses, and cash flow when evaluating its financial health.

Question 5: How can I stay up to date on the latest developments with BioNTech?

Answer: The company's website, SEC filings, and press releases provide valuable information for investors. Additionally, industry news sources and financial analysts can provide insights into BioNTech's progress.

Question 6: What are the potential returns on investment in BioNTech?

Answer: The potential returns on investment in BioNTech are highly dependent on the company's future performance and the broader market conditions. However, the company's strong pipeline and significant market opportunities suggest the potential for significant returns over the long term.

In conclusion, BioNTech is a promising investment opportunity with a strong pipeline of potential therapies and a clear long-term growth strategy. However, as with any investment, it is essential to understand the risks involved and conduct thorough research before making a decision.

Next, we will delve into the financial performance of BioNTech, providing insights into its revenue growth, profit margins, and other key metrics.

Biontech-aktie Frankfurt - Source kacamatatebel.blogspot.com

Tips

To maximize returns on BioNTech Aktie: Ein Umfassender Leitfaden Für Investoren investments, consider the following essential tips:

Tip 1: Conduct thorough research.

Before investing in BioNTech stock, delve deeply into the company's financial performance, market position, and growth prospects. Assess its competitive landscape, regulatory environment, and potential risks.

Tip 2: Diversify your portfolio.

Avoid concentrating your investments solely in BioNTech shares. Spread your risk by allocating funds across a range of stocks in different industries and sectors. This strategy mitigates the impact of any single stock's underperformance.

Tip 3: Invest for the long term.

BioNTech is a growth stock with long-term potential. Avoid short-term trading and focus on holding the stock for a period of several years to reap the benefits of its anticipated growth.

Tip 4: Monitor market news and events.

Stay informed about industry trends, regulatory changes, and other factors that could impact BioNTech's stock price. Timely adjustments to your investment strategy based on market developments can enhance your returns.

Tip 5: Consider your risk tolerance.

Assess your financial situation and risk tolerance before investing in BioNTech. The stock's volatility may not be suitable for all investors. Determine an appropriate investment amount that aligns with your risk appetite.

Tip 6: Seek professional advice.

If necessary, consult with a financial advisor who can provide personalized guidance based on your individual circumstances and investment goals. Professional advice can help you make informed decisions and optimize your returns.

Tip 7: Be patient.

Investing in growth stocks requires patience. BioNTech's stock price may fluctuate in the short term, but its long-term growth potential can yield substantial returns for patient investors.

By following these tips, investors can increase their chances of maximizing their returns on BioNTech stock while mitigating potential risks.

BioNTech Aktie: Ein Umfassender Leitfaden Für Investoren

Investing in BioNTech Aktien erfordert eine sorgfältige Prüfung verschiedener Aspekte, welche die Entscheidungsfindung beeinflussen. Dieser Leitfaden beleuchtet sechs entscheidende Bereiche, die Anleger berücksichtigen sollten, um eine fundierte Wahl zu treffen.

- Unternehmensperformance: Finanzdaten, Forschungserfolge, Marktaussichten.

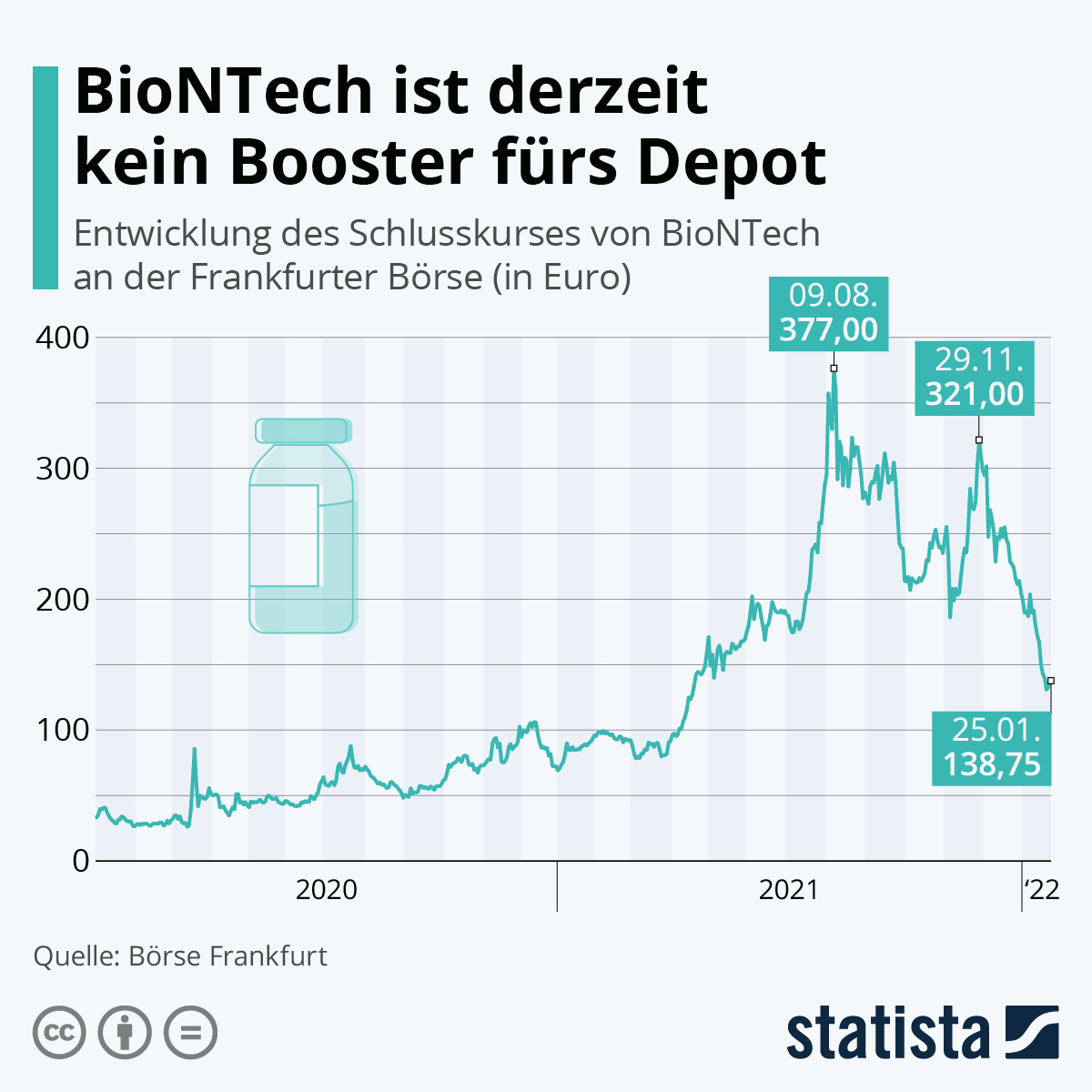

- Aktienkursanalyse: Technische Indikatoren, Chartmuster, Bewertung.

- Wettbewerbslandschaft: Mitbewerber, Markteintrittsbarrieren, Technologievorteile.

- Makroökonomische Faktoren: Zinsumfeld, Konjunkturlage, regulatorisches Umfeld.

- Nachrichten und Ereignisse: Neuigkeiten, Ankündigungen, Partnerschaften.

- Risikomanagement: Diversifizierung, Absicherungsstrategien, Verlustbegrenzung.

Durch sorgfältige Prüfung dieser Aspekte können Investoren fundierte Entscheidungen über BioNTech Aktien treffen. Die Bewertung der Unternehmensperformance und der Aktienkursanalyse bietet Einblicke in die Finanzkraft und das Wachstumspotenzial. Die Analyse der Wettbewerbslandschaft und makroökonomischer Faktoren hilft, externe Risiken und Chancen zu identifizieren. Die Überwachung von Nachrichten und Ereignissen hält Investoren über wichtige Entwicklungen auf dem Laufenden, während effektives Risikomanagement hilft, potenzielle Verluste abzumildern. Die Berücksichtigung dieser sechs Aspekte stellt sicher, dass Investoren eine umfassende Sicht auf BioNTech Aktien haben und fundierte Entscheidungen treffen können.

Biontech-Aktie bricht ein, Deckelung der Rundfunkgebühren?, Mindestlohn - Source www.zaster-magazin.de

BioNTech Aktie: Ein Umfassender Leitfaden Für Investoren

The connection between "BioNTech Aktie: Ein Umfassender Leitfaden Für Investoren" lies in its comprehensive exploration of the topic. This guide serves as an invaluable resource, providing investors with a thorough understanding of BioNTech's stock performance, market dynamics, and investment strategies.

Biontech Aktie Kurs Aktuell / Alle Impfstoff Aktien Fallen Wie Die - Source ohitzlawrence.blogspot.com

The importance of this topic stems from BioNTech's significant role in the development and distribution of mRNA vaccines, particularly during the COVID-19 pandemic. Understanding the company's stock performance is crucial for investors seeking exposure to the healthcare sector and the biotechnology industry.

This guide examines factors influencing BioNTech's stock price, including its financial performance, research and development initiatives, and regulatory landscape. It also analyzes market trends, competition, and potential risks and opportunities associated with investing in the company.

The practical significance of this understanding empowers investors to make informed decisions regarding their investments in BioNTech. By understanding the company's strengths, weaknesses, and market dynamics, investors can assess the potential risks and rewards associated with investing in its stock.

Conclusion

This comprehensive guide on BioNTech stock provides investors with the necessary knowledge and insights to navigate the complexities of the healthcare sector and make informed investment decisions. Its exploration of the company's stock performance, market dynamics, and investment strategies serves as a valuable resource for investors seeking growth and diversification in their portfolios.

As BioNTech continues to play a significant role in the healthcare industry, investors are well-advised to stay abreast of the company's developments and market trends. This guide serves as a foundation for ongoing research and analysis, enabling investors to capitalize on the potential opportunities presented by BioNTech's stock.