Today, people seek financial confidence more than ever in the face of economic uncertainty. Citi is committed to helping clients achieve this goal through its Premium Banking Experience. Citi provides a comprehensive suite of banking and wealth management services and access to exclusive benefits and rewards, tailored to meet the needs of high-net-worth individuals and families.

Editor's Notes: "Unlock Financial Confidence With Citi: The Premium Banking Experience" was published today due to the unprecedented times where financial confidence is of the utmost importance.

Through extensive analysis and research, we've created this guide to help you make informed decisions about your financial future and unlock the benefits of Citi's Premium Banking Experience.

| Feature | Citi Premium Banking |

|---|---|

| Dedicated Relationship Manager | Yes |

| Tailored Financial Advice | Yes |

| Exclusive Investment Opportunities | Yes |

| Priority Banking Services | Yes |

| Concierge Services | Yes |

Citi's Premium Banking Experience offers a range of benefits, including:

FAQ

This comprehensive FAQ section aims to address common inquiries and provide valuable information to enhance your understanding of the premium banking experience with Citi.

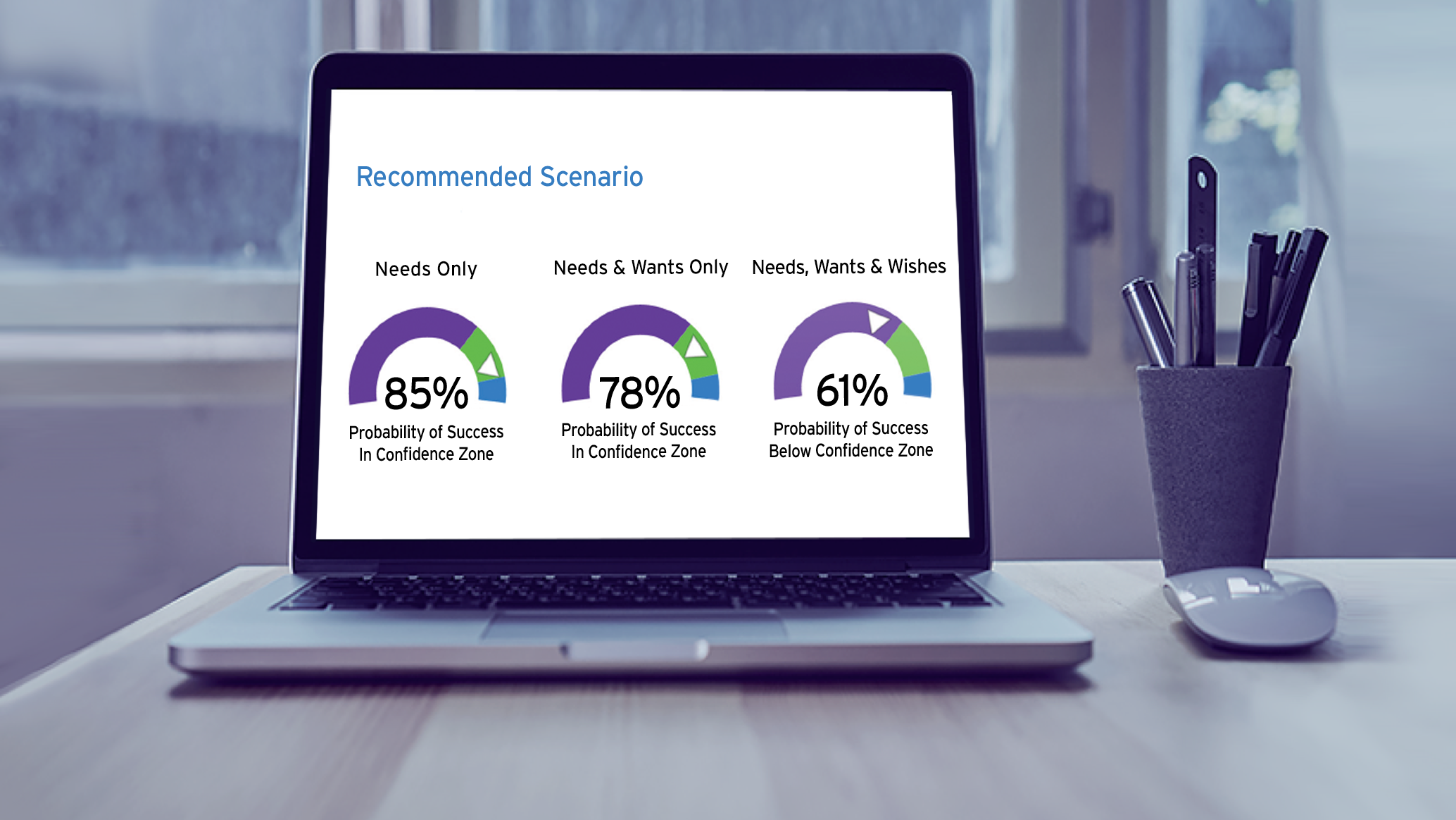

Personalize Your Financial Plan With Citi Wealth Advisor - Citibank - Source online.citi.com

Question 1: What sets Citi's Premium Banking experience apart from other financial institutions?

Citi's Premium Banking service offers an exclusive suite of benefits and services tailored to meet the discerning needs of its clientele. These include personalized wealth management advice, priority banking services, exclusive privileges, and specialized insights to support financial growth.

Question 2: What criteria are used to qualify for Citi's Premium Banking service?

To qualify for Premium Banking, individuals typically need to meet certain requirements, such as maintaining a minimum account balance or having a consistent track record of financial transactions. It's recommended to contact Citi's financial advisors to discuss eligibility and explore options.

Question 3: What are the specific benefits and privileges available to Premium Banking customers?

Premium Banking clients enjoy an array of benefits, including dedicated relationship managers, personalized financial planning, exclusive investment opportunities, lifestyle privileges, and access to exclusive events and experiences.

Question 4: How does Citi ensure the security and privacy of its Premium Banking clients?

Citi places the utmost importance on security and privacy. The bank employs advanced encryption technologies, robust authentication measures, and stringent regulatory compliance to safeguard client information and transactions.

Question 5: What distinguishes Citi's wealth management services from those of other institutions?

Citi's wealth management team comprises seasoned professionals who provide tailored advice and solutions based on each client's unique financial goals. They leverage proprietary research and insights to navigate market complexities and optimize investment strategies.

Question 6: How can I access Citi's Premium Banking services?

To inquire about Premium Banking eligibility and services, you can visit a Citi branch, call the dedicated hotline, or schedule an appointment with a Citi financial advisor. They will assess your financial profile and guide you through the application process.

By addressing these common concerns, we hope to provide clarity and enhance your understanding of the premium banking experience offered by Citi.

To learn more about Citi's Premium Banking services and discover how they can empower your financial journey, visit our website or contact our financial advisors.

Tips

Enhance your financial well-being with these exclusive tips from Unlock Financial Confidence With Citi: The Premium Banking Experience:

Tip 1: Leverage Digital Banking Tools

Simplify financial management by utilizing mobile banking apps and online platforms. Monitor transactions, pay bills, and access account information seamlessly.

Tip 2: Optimize Savings Strategies

Develop tailored savings plans to meet your long-term goals. Consider high-yield savings accounts and investment options to maximize returns.

Tip 3: Consolidate Debt

Streamline debt repayment by consolidating multiple accounts into a single, lower-interest loan. This reduces financial burden and simplifies payments.

Tip 4: Build an Emergency Fund

Prepare for unforeseen events by establishing an emergency fund. Set aside a portion of your income to cover unexpected expenses and safeguard your financial stability.

Tip 5: Seek Professional Financial Advice

Access personalized guidance from financial advisors. They can provide tailored recommendations and strategies to meet your specific needs and aspirations.

Summary:

By incorporating these tips into your financial routine, you can unlock greater confidence and achieve financial success. Embark on this journey with Citi's premium banking experience and empower your financial future.

Unlock Financial Confidence With Citi: The Premium Banking Experience

Navigating the complexities of personal finance can be daunting, but with Citi's Premium Banking Experience, you can Unlock Financial Confidence. This exclusive banking suite empowers individuals with tailored solutions and expert guidance.

- Personalized Planning: Expert financial advisors craft customized strategies tailored to your unique financial goals.

- Proactive Insights: Advanced analytics and market intelligence provide timely and actionable insights to stay ahead.

- Exclusive Investment Opportunities: Access to a curated portfolio of exclusive investment products and exclusive market access.

- Tailored Credit Solutions: Premium banking members enjoy access to tailored credit solutions designed to meet their specific needs.

- Lifestyle Benefits: Exclusive offers, including concierge services, travel rewards, and curated experiences, enhance your lifestyle.

- Dedicated Relationship Management: A dedicated relationship manager provides personalized attention, guidance, and support.

10 Tips To Achieve Financial Confidence In The Next 30 Days - Afam Uche - Source afamuche.com

By leveraging these six pillars, Citi's Premium Banking Experience provides a comprehensive solution that helps its members achieve financial confidence. Its tailored approach empowers individuals to make informed decisions, navigate market complexities, and ultimately secure their financial future.

Unlock Financial Confidence With Citi: The Premium Banking Experience

The connection between "Unlock Financial Confidence With Citi: The Premium Banking Experience" lies in the ability to provide comprehensive financial solutions tailored to individual needs. This premium banking experience empowers individuals to achieve their financial goals through personalized guidance and tailored financial products.

Investment Banking Vice President CV Example for 2023 | Resume Worded - Source resumeworded.com

The importance of this topic stems from the growing need for individuals to navigate complex financial landscapes and make informed decisions to secure their financial well-being. The premium banking experience provides a strategic partnership to guide clients through these complexities, facilitating financial literacy and empowering them to make informed choices.

In practice, this understanding translates into practical benefits such as access to exclusive financial products, personalized financial planning, and dedicated support from experienced banking professionals. By leveraging the expertise and resources of premium banking institutions, individuals can streamline their financial management, optimize their investment strategies, and achieve their long-term financial goals with greater confidence and efficiency.

In conclusion, the connection between "Unlock Financial Confidence With Citi: The Premium Banking Experience" lies in the empowerment of individuals to take control of their financial journey. Through tailored solutions, expert guidance, and a comprehensive suite of financial services, premium banking experiences foster financial literacy, promote sound financial decision-making, and ultimately unlock the confidence needed to achieve financial success.