Retirement Planning: A Comprehensive Guide To Secure Your Financial Future, is an essential step towards ensuring a comfortable and secure retirement. This guide provides a roadmap for individuals to navigate the complexities of retirement planning, empowering them to make informed decisions that will safeguard their financial well-being in their golden years.

Editor's Notes: Retirement Planning: A Comprehensive Guide To Secure Your Financial Future has been published today, addressing the critical need for individuals to plan for their retirement. With increasing life expectancies and rising healthcare costs, it is more important than ever to have a sound financial plan in place to ensure a secure and fulfilling retirement.

Through extensive analysis and research, we have compiled this guide to provide a comprehensive overview of retirement planning. Our goal is to equip individuals with the knowledge and tools they need to make informed decisions about their retirement savings, investments, and lifestyle choices.

Key Differences or Key Takeaways:

Transition to main article topics:

FAQ

This comprehensive guide provides answers to frequently asked questions about retirement planning, empowering you to make informed decisions for a secure financial future.

Question 1: When should I start planning for retirement?

Ideally, retirement planning should commence as early as possible, ideally during your 20s or 30s. The earlier you start saving and investing, the longer your portfolio will have to grow, maximizing future returns.

Question 2: What factors should I consider when determining my retirement savings goals?

Consider your current age, income, planned retirement age, desired lifestyle in retirement, and any potential healthcare expenses. These factors will assist you in establishing realistic savings goals that align with your specific needs.

Question 3:

Retirement Planning | JamaPunji - Source jamapunji.pk

Question 4: What are the different investment strategies available for retirement planning?

There are various investment strategies to choose from, each with varying risk and return profiles. Options include stocks, bonds, mutual funds, and real estate. Your investment strategy should align with your risk tolerance, investment horizon, and financial goals.

Question 5: How do I minimize taxes on my retirement savings?

Utilizing tax-advantaged accounts, such as IRAs and 401 (k) plans, allows you to save on taxes either upfront or during retirement. These accounts offer tax deferral or tax-free withdrawals, depending on the account type.

Question 6: What should I do if I'm behind on my retirement savings?

Don't panic. It's never too late to start saving. Take immediate action by increasing your contribution rates, exploring catch-up contributions, and seeking professional financial guidance to develop a personalized savings plan that aligns with your unique circumstances and goals.

Retirement planning is a critical aspect of financial well-being. By addressing these common concerns and misconceptions, individuals can make informed decisions to secure their future.

Continue to the next article section for further insights into creating a comprehensive retirement plan.

Tips

Retirement planning is a crucial aspect of financial security. To achieve a comfortable and secure retirement, certain steps should be taken well in advance. Consider the following tips to navigate retirement planning effectively.

Tip 1: Start Early and Regularly Contribute to Retirement Accounts

Beginning retirement savings early allows for the power of compounding interest to maximize returns. Regular contributions, regardless of the amount, establish a consistent savings habit and foster financial discipline.

Tip 2: Determine Retirement Goals and Set Realistic Targets

Define a clear retirement vision to guide financial decisions. Estimate expenses, adjust for inflation, and determine the necessary income streams to support the desired lifestyle. Setting realistic targets ensures achievable goals that prevent disappointment.

Tip 3: Research and Utilize Relevant Retirement Plans

Explore different retirement plans, such as 401(k)s, IRAs, and annuities, to identify those that align with financial objectives and risk tolerance. Understanding the tax implications and contribution limits of each plan optimizes savings strategies.

Tip 4: Diversify Investments and Manage Risk

A well-diversified portfolio reduces risk and enhances returns. Invest in a mix of asset classes, such as stocks, bonds, and real estate, to balance potential gains and losses. Regular portfolio reviews and adjustments ensure alignment with changing economic conditions.

Tip 5: Consider Annuities and Guaranteed Income Streams

Annuities provide guaranteed income streams to supplement retirement savings. They offer peace of mind by mitigating longevity risk and ensuring a steady flow of income during retirement years. Explore different annuity options and select the one that best meets financial needs.

Tip 6: Seek Professional Advice

To navigate the complexities of retirement planning effectively, consider consulting with a qualified financial advisor. They provide personalized guidance, tailored to individual circumstances, and help create a comprehensive retirement plan that maximizes financial security.

Retirement planning requires a proactive and disciplined approach. By implementing these tips and strategies, individuals can secure their financial future and enjoy a comfortable and well-deserved retirement.

Retirement Planning: A Comprehensive Guide To Secure Your Financial Future

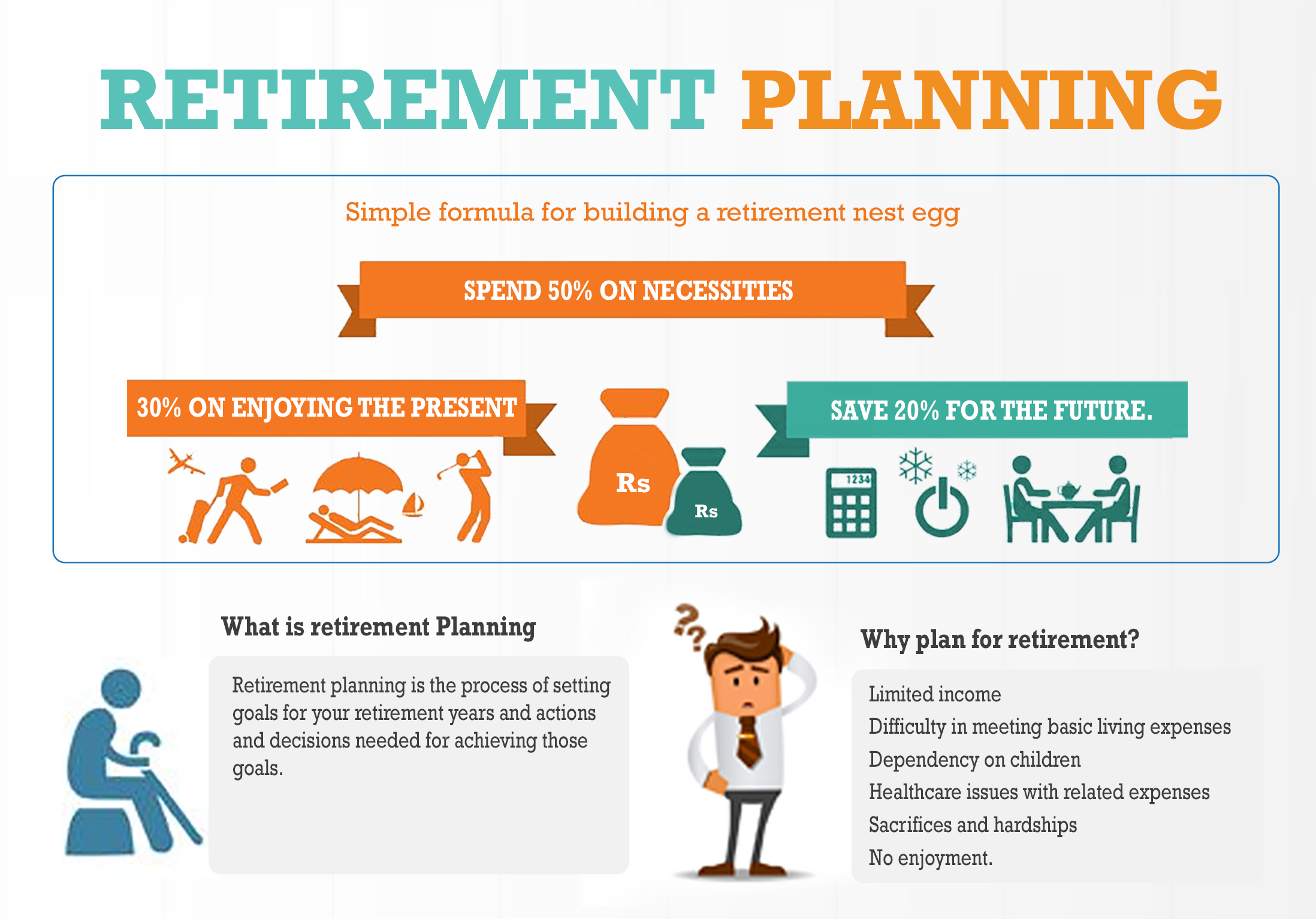

Retirement planning is paramount for securing one's financial well-being in their golden years. It encompasses various essential aspects that require careful consideration.

- Time Horizon: Determine the duration of retirement to estimate required savings.

- Financial Goals: Define specific financial objectives, such as lifestyle needs and expenses.

- Risk Tolerance: Assess the ability to withstand market fluctuations and tailor investments accordingly.

- Investment Strategy: Choose a mix of assets that aligns with risk tolerance and financial goals.

- Tax Efficiency: Optimize tax savings through retirement accounts and appropriate investment choices.

- Estate Planning: Ensure seamless wealth transfer and minimize inheritance taxes.

Planning for your Retirement | Department of Insurance, SC - Official - Source doi.sc.gov

These key aspects are interconnected and essential for a robust retirement plan. For instance, a longer time horizon allows for a more aggressive investment strategy, while a higher risk tolerance may yield greater returns. Tax efficiency can reduce the overall cost of retirement, while estate planning safeguards wealth for future generations. By addressing these considerations, individuals can enhance their financial security and ensure a comfortable and fulfilling retirement.

Retirement Planning: A Comprehensive Guide To Secure Your Financial Future

Retirement planning is essential for securing financial stability during retirement years. It entails a systematic approach to managing finances, investments, and lifestyle choices to ensure a comfortable and secure retirement. Understanding the connection between various aspects of retirement planning is crucial for developing an effective plan.

Going solo: Tips to secure your financial future as a single woman - Source www.indiafirstlife.com

For instance, understanding the relationship between savings and investment is pivotal. Regular savings and contributions to retirement accounts, such as 401(k)s and IRAs, form the foundation of retirement funds. Investing these funds wisely can help grow assets over time, generating income during retirement. Additionally, understanding the impact of taxes on retirement savings is essential for optimizing investment decisions and tax liabilities.

Furthermore, considering the connection between lifestyle and retirement planning is crucial. Making conscious choices, such as downsizing housing, managing expenses, and pursuing hobbies that generate income, can contribute to financial security during retirement. The interplay between healthcare costs and retirement planning is also significant, as anticipating and preparing for potential healthcare expenses can help ensure financial preparedness.

In conclusion, understanding the interconnectedness within retirement planning is vital. By integrating savings, investments, lifestyle choices, and healthcare planning, individuals can create a comprehensive plan to secure their financial future. Retirement planning is a multifaceted endeavor that requires a holistic approach to ensure a comfortable and fulfilling retirement.

Conclusion

Retirement planning requires careful consideration and a comprehensive approach to ensure financial security and a comfortable retirement. Understanding the connection between its various aspects is pivotal in developing an effective plan.

By integrating savings, investments, lifestyle choices, and healthcare planning, individuals can make informed decisions and optimize their retirement strategy. The decisions made during retirement planning will have a profound impact on the quality of life and financial well-being during retirement years. Therefore, it is imperative to engage in thorough planning and seek professional advice when necessary to secure a fulfilling and financially secure retirement.